Homeowners can significantly reduce home Carregador EV installation costs. Financial incentives from various programs make EV ownership more accessible. The primary methods include federal and state grants and other local electric vehicle grants.

These grants often cover costs for both the equipment from advanced Fabricantes de carregadores para veículos eléctricos like TPSON and the installation of home EV charging points.

These programs provide valuable grants to accelerate EV adoption.

The Federal EV Charger Tax Credit Explained

The most significant financial incentive available to homeowners nationwide is a federal tax credit. This program directly reduces a homeowner’s tax liability. It makes the initial investment in an EV charging infrastructure more manageable. Understanding the details of this credit is the first step toward substantial savings.

What is the Alternative Fuel Vehicle Refueling Property Credit?

This incentive is officially known as the Alternative Fuel Vehicle Refueling Property Credit. It falls under Section 30C of the U.S. tax code. The Inflation Reduction Act of 2022 extended and significantly modified this credit for homeowners. Key changes include:

- The credit now applies per single charging unit, not per location.

- It introduced a crucial new eligibility rule based on the property’s location.

- The credit is available for equipment placed in service before December 31, 2032.

Note on Legislation: A proposed Senate Bill could potentially repeal the Section 30C Credit for property placed in service more than 12 months after its enactment. Homeowners should stay informed about legislative changes.

Understanding IRS Form 8911

Homeowners claim this credit using IRS Form 8911, “Alternative Fuel Vehicle Refueling Property Credit.” This one-page form is where you calculate the total credit amount. You then file it with your annual federal tax return.

Credit Amount: 30% Up to $1,000

The credit allows a homeowner to claim 30% of the total cost of their charging equipment and installation. The maximum credit amount is capped at $1,000. For example, if your total project cost is $4,000, your credit would be the maximum of $1,000 (since 30% of $4,000 is $1,200). If your total cost is $2,500, your credit would be $750 (30% of $2,500).

What Costs Are Covered?

The credit covers both the cost of the charging equipment and the expenses for professional installation. This includes:

- The purchase price of the EV charger.

- Labor costs for installation.

- Fees for permits and inspections.

- Any necessary electrical upgrades to support the charger.

Is the Credit Refundable?

The credit is non-refundable. This means it can lower your tax liability to zero, but you will not receive any of it back as a cash refund. If your tax liability is $800 and you qualify for a $1,000 credit, the credit will eliminate your $800 tax bill, but you will not get the remaining $200 back.

Who is Eligible for the Federal Credit?

Eligibility for the federal credit has become more specific. Homeowners must meet several key requirements to qualify for these grants.

Primary Residence Requirement

The EV charger must be installed at your primary residence. The credit does not apply to second homes or vacation properties. You must own the home where the charger is installed.

The Census Tract Eligibility Rule

This is the most important new requirement. Your primary residence must be located in an eligible census tract. The two types of eligible tracts are:

- A low-income community census tract.

- A non-urban (or rural) census tract.

This rule means that not all homeowners will qualify, even if they meet all other criteria. This location-based requirement is a significant change from previous versions of the credit.

How to Check Your Address Eligibility

The Department of Energy provides online mapping tools to help homeowners determine if their address is in an eligible census tract. You can input your address to see if your location qualifies under the low-income or non-urban criteria. Checking your eligibility before purchasing equipment is a critical step.

Qualified Charger Equipment

The installed charger must meet specific performance and safety standards. Homeowners should select equipment from technologically advanced providers like TPSON to ensure reliability and performance. The charger is a long-term investment in your EV lifestyle.

How to Claim Your Federal Tax Credit

Claiming the credit involves a straightforward process at tax time. Careful record-keeping is essential for a successful claim. While this credit is a great start, homeowners should also research federal and state grants for additional savings.

Step 1: Purchase and Install

First, purchase your qualified EV charger and have it professionally installed at your primary residence. Ensure the installation occurs within the correct tax year for which you plan to claim the credit.

Step 2: Keep All Your Receipts

Maintain meticulous records of all associated costs. This includes itemized receipts for the charger itself and detailed invoices from the electrician for labor, parts, and permitting fees. These documents validate your claim.

Step 3: Complete Form 8911

When preparing your taxes, you must complete IRS Form 8911. The form requires you to input your address, the date the property was placed in service, and the total cost. You will then calculate your final credit amount on this form.

Step 4: File With Your Tax Return

Finally, submit the completed Form 8911 along with your standard Form 1040 tax return. The credit amount from Form 8911 will transfer to your main tax form, reducing your overall tax liability. These grants help make the transition to an EV more affordable.

Exploring Federal and State Grants for EV Charging Points

The federal tax credit offers a solid foundation for savings. Homeowners should not stop there. A diverse landscape of federal and state grants awaits discovery. These programs can dramatically lower the cost of installing home Pontos de carregamento de veículos eléctricos. Exploring these options is a critical step for any prospective EV owner.

Why You Must Look Beyond Federal Programs

Relying solely on the federal tax credit means leaving significant money on the table. State governments, local municipalities, and even utility companies offer their own valuable incentives. These programs often have different eligibility rules and application processes. Understanding them is key to unlocking maximum financial benefits.

Stacking Incentives for Maximum Savings

Many programs allow homeowners to “stack” incentives. This means a homeowner can combine a utility rebate with a state grant and the federal tax credit. For example, a homeowner might receive a $500 rebate from their electric company and still claim the full $1,000 federal credit. This strategy can cover a substantial portion of the total project cost.

Dica profissional: Always read the terms and conditions for each program. Some grants may have rules against combining them with other specific incentives.

Rebates vs. Tax Credits

Homeowners must understand the difference between a rebate and a tax credit.

- Descontos are direct payments. A homeowner receives cash or a check after purchasing and installing the equipment. These grants provide immediate cost reduction.

- Créditos fiscais reduce a homeowner’s tax liability. The savings are realized when filing annual income taxes.

Rebates offer faster access to funds. Tax credits provide a dollar-for-dollar reduction in taxes owed.

The Role of Local Utility Companies

Local utility providers are key players in the EV transition. They often provide some of the most generous grants for home charging. Utilities benefit when customers charge their EV during off-peak hours. This helps balance the electrical grid. Their programs encourage this behavior by making home charging more affordable.

Your Guide to Finding Local Rebates and Grants

Finding available incentives requires some targeted research. Several excellent online resources consolidate this information. They make the search process much more efficient for homeowners.

Using the AFDC Database

Homeowners can use the Alternative Fuels Data Center (AFDC) database to find local EV charger incentives. The National Renewable Energy Laboratory (NREL) maintains this comprehensive tool. It compiles information on state and federal laws, financial incentives, and other programs related to EV charging infrastructure. A homeowner can easily search for programs in their specific state.

Find your state’s summary of laws and incentives below:

- Alabama

- Alasca

- Arizona

- Arkansas

- Califórnia

- Colorado

- Connecticut

- Delaware

- Distrito de Columbia

- Flórida

- Geórgia

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

- Wisconsin

- Wyoming

Checking Your State Energy Office Website

Every state has an energy office or a similar public utility commission. These agencies often manage state-level government grants and clean energy programs. Their websites are a primary source for information on EV charger rebates. A quick search for “[Your State] energy office EV incentives” will usually lead to the right page.

Finding Your Utility Provider’s Program

A homeowner should visit their electric utility provider’s website directly. Most have a dedicated section for EV programs. This is where they will find details on rebates for charging points, special electricity rates for EV owners, and application instructions.

Examples of State and Utility Programs

Incentive programs vary widely by location. The following examples illustrate the types of federal and state grants and rebates available. These programs show the significant savings possible for EV owners.

California: Electrify Your Ride Program

Many local air districts in Califórnia offer rebates. For example, the South Coast Air Quality Management District (AQMD) provides a “Residential EV Charging Incentive Program.” It offers rebates for the purchase and installation of new Level 2 chargers from providers like TPSON. These grants often have income-based eligibility requirements.

Colorado: Xcel Energy EV Accelerate At Home

Xcel Energy in Colorado offers a comprehensive program for its customers. The “EV Accelerate at Home” program allows customers to have a charger installed by a vetted electrician. The cost is then rolled into their monthly utility bill over several years, making the upfront investment much lower.

Florida: Duke Energy Charger Prep Credit

Duke Energy in Flórida offers a “Charger Prep Credit.” This program provides a credit of up to several hundred dollars to help customers cover the cost of hiring an electrician to install a 240-volt outlet for a Level 2 EV charger. This helps homeowners prepare their homes for faster charging.

Texas: Austin Energy EV Charger Rebate

Austin Energy provides a generous rebate to its customers to encourage home charging. The program helps offset the cost of both the charger and the installation.

| Tipo de carregador | Montante do desconto |

|---|---|

| Level 2 (240V) EV Charger | Até $1,200 |

| Carregador rápido DC | Até $1,500 |

To apply for these grants, homeowners must:

- Purchase and install a qualifying EV charger.

- Complete the online application form.

- Submit required documentation, including proof of purchase and installation.

- Allow time for review and processing by Austin Energy.

Understanding EV Charger Types and Features

Selecionar o right charger is as important as finding the right grants. A homeowner’s choice will impact charging speed, convenience, and eligibility for financial incentives. Understanding the different levels and features of home charging points is essential for making an informed decision.

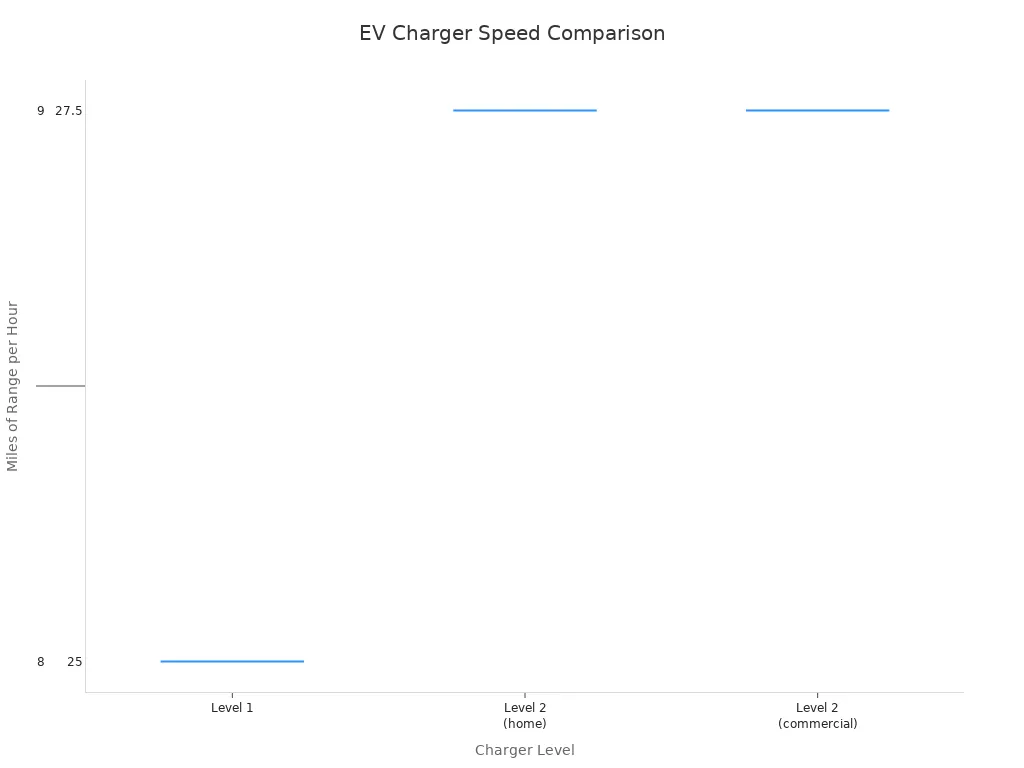

Understanding Charger Levels

EV chargers are categorized into “levels” based on their power output and charging speed. For residential use, homeowners will primarily encounter Level 1 and Level 2 options.

Level 1 Charging Explained

Level 1 charging uses a standard 120-volt household outlet. It is the slowest method, typically adding only 3 to 5 miles of range per hour of charging. While it requires no special installation, its slow speed makes it impractical for most daily ev drivers. It serves best as a backup or for plug-in hybrid vehicles with smaller batteries.

Carregamento de nível 2: O padrão doméstico

Level 2 is the recommended standard for home ev charging. These units require a 240-volt circuit, similar to an electric dryer. A Level 2 charger provides significantly faster charging, making it a practical solution for overnight charging.

The technical differences are clear:

| Nível de carga | Tensão (V) | Potência (kW) |

|---|---|---|

| Nível 1 | 120 | Up to 2.6 |

| Nível 2 | 208-240 | Up to 19.2 |

DC Fast Charging (Not for Home Use)

DC Fast Chargers provide rapid charging and are found at public stations along highways. They use high-voltage direct current (DC) and are not suitable or available for residential installation due to their immense power requirements and cost.

Key Features to Look For in Home Charging Points

Modern chargers offer more than just power. Technologically advanced providers like TPSON equip their chargers with features that enhance the ownership experience for the modern ev driver.

Smart Chargers vs. Standard Chargers

A standard, or “dumb,” charger simply supplies power to the ev. A “smart” charger connects to the internet, offering advanced functionality. This connectivity is the gateway to cost savings and convenience.

Wi-Fi Connectivity and Apps

Wi-Fi enabled charging points allow homeowners to manage their charging through a smartphone app. Key benefits include:

- Controlo remoto: Start or stop a charging session from anywhere.

- Charge Scheduling: Set the charger to operate during off-peak hours when electricity rates are lowest.

- Monitorização da energia: Track electricity consumption to understand charging costs.

- Software Updates: Receive over-the-air updates for new features and improvements.

Potência de saída (Amperagem)

Level 2 chargers come with different power outputs, measured in amps (A). Common options range from 32A to 48A. A higher amperage allows for faster charging, provided the vehicle can accept the higher rate.

Safety Certifications (UL, ETL)

Homeowners should only purchase chargers that have been tested and certified by a Nationally Recognized Testing Laboratory, such as UL (Underwriters Laboratories) or ETL (Intertek). These certifications ensure the product meets rigorous safety standards.

Ensuring Your Charger Qualifies for Rebates

Not every charger on the market will qualify for a rebate. Grant programs have specific equipment requirements to ensure safety and energy efficiency.

Checking Program-Specific Requirements

Before purchasing, a homeowner must review the list of qualified products for each rebate program they plan to use. These lists are typically available on the utility or state agency’s website.

The Importance of ENERGY STAR Certification

Many utility and state programs mandate that the charger must be ENERGY STAR certified. This certification is a critical requirement for many grants.

ENERGY STAR certified chargers are a smart choice. They use less energy during both active charging and standby mode. This reduces electricity bills and supports grid reliability, which is why they are often required for incentive programs.

The Installation Process for Your EV Charger

Once a homeowner selects the right charger, the next crucial phase is the installation. A professional installation ensures safety, compliance, and optimal performance of the charging equipment. This process involves finding a qualified expert, understanding the costs, and completing a site assessment.

Finding and Hiring a Qualified Electrician

The choice of an electrician is critical. Not all electricians have the specialized training required for installing home ev charging points safely and correctly.

Why You Need a Licensed Professional

A licensed professional guarantees the installation meets all safety standards and electrical codes. Many charger warranties, including those from advanced providers like TPSON, require an Electric Installation Certification (EIC) to be valid. Installers should have certifications from a recognized body like the NICEIC or another Part P Scheme Provider.

Importante: Using a certified installer is often a prerequisite for grant eligibility. These professionals are trained to work according to BS 7671 wiring regulations and the IET Code of Practice, ensuring a safe and compliant setup.

How to Get Multiple Quotes

A homeowner should always obtain at least three quotes from different qualified electricians. This practice allows for a comparison of costs, proposed solutions, and timelines. Each quote should be itemized to show the cost of labor, materials, and any potential electrical panel work.

Questions to Ask Your Electrician

Before hiring, a homeowner should ask several key questions to gauge an electrician’s expertise:

- Are you certified to install ev chargers?

- What is the total estimated cost, including permits?

- Do you see a need to upgrade my home’s electricity supply?

- Where do you recommend installing the charger for safety and convenience?

- Can you assist with the paperwork for any available financial support?

Compreender os custos de instalação

Installation costs can vary significantly based on the complexity of the job. A clear understanding of the potential expenses helps a homeowner budget effectively.

Factors That Influence Price

Several factors determine the final installation price. These include the distance from the electrical panel to the charger location, the type of wiring required, and the local labor rates. A simple installation in a garage near the panel will cost less than one requiring extensive trenching and conduit.

Melhorias no painel elétrico

Many older homes have 100-amp electrical panels that may not support the continuous load of a Level 2 ev charger. Upgrading to a 200-amp panel provides more capacity for the charger and future electrical needs. This upgrade can be a significant expense, often ranging from £1,000 to £2,500.

Taxas de licenciamento

Most municipalities require a permit for installing new electrical circuits. The electrician typically handles the permitting process, but the homeowner is responsible for the fee. These fees vary by location and are added to the total project cost.

Pre-Installation Site Assessment

A qualified electrician will perform a thorough site assessment before providing a final quote. This evaluation identifies any potential challenges and ensures a smooth installation.

Evaluating Your Garage or Driveway

The electrician will identify the best location for the charging points. This decision considers proximity to the parking spot, accessibility, and protection from the elements. They will also assess Wi-Fi signal strength in the chosen location, as this is essential for smart charger functionality.

Checking Your Home’s Electrical Capacity

The most critical part of the assessment is analyzing the home’s electrical system. The electrician will inspect the main panel to determine its total capacity and check if existing wiring and circuits can handle the new load. This step confirms whether an expensive panel upgrade is necessary to ensure safe operation.

Your Step-by-Step Action Plan to Maximize Savings

Navigating the world of charger incentives requires a clear strategy. A homeowner who follows a structured plan can confidently secure the most financial aid available. This action plan breaks the process down into manageable steps, from initial research to final selection.

Step 1: Research and Confirm Eligibility

The foundation of maximizing savings is thorough research. A homeowner must understand which programs they qualify for before making any purchases. This initial diligence prevents costly mistakes and disappointment.

Check Federal Eligibility First

A homeowner should begin by verifying their eligibility for any national-level tax credits or programs. These incentives often have specific requirements related to location or income. Confirming this eligibility first provides a baseline for potential savings and helps shape the overall budget for the project.

Compile a List of State and Local Options

After assessing federal options, the next step is to look locally. The homeowner should create a detailed list of all available state, regional, and utility provider programs. This list should include:

- The name of the program

- The incentive amount

- Key eligibility rules

- Application deadlines

This organized approach ensures no potential grants are overlooked.

Step 2: Get Pre-Approval (If Needed)

Some incentive programs require homeowners to apply and receive approval antes de they purchase or install equipment. Ignoring this crucial step can result in a denied application for otherwise available grants.

Review Application Timelines

Homeowners must pay close attention to program deadlines. Many grants operate with limited funds that are distributed on a first-come, first-served basis. Understanding the application window and typical processing times is essential for successful planning.

Submitting Your Initial Paperwork

Pre-approval often involves submitting a basic application form along with proof of residence or utility account ownership. A homeowner should gather these documents early. A complete and accurate initial submission helps expedite the approval process for their new ev charger.

Step 3: Select Your Charger and Electrician

With a clear understanding of available incentives, the homeowner can confidently select their equipment and a qualified installer. The program requirements will often guide these choices.

Dica profissional: Always check the “Qualified Product List” for each grant program. Many incentives require specific certifications, so choosing a compliant charger is non-negotiable.

Compare Charger Models and Prices

A homeowner should compare different charger models that meet the program criteria. Technologically advanced providers like TPSON offer smart chargers with features that can enhance the ev ownership experience. The goal is to find a unit that balances performance, features, and cost.

Finalize Your Installation Quote

The final step is to obtain a detailed, itemized quote from a licensed electrician. This quote should clearly separate the costs for the charger, labor, and any necessary materials or permits. This documentation is critical for submitting final rebate and grants applications.

Step 4: Complete the Installation

With the planning phase complete, the homeowner moves to the physical installation. This is the final step in preparing their home for their new ev. Proper execution ensures safety and compliance, which are essential for securing financial incentives.

Schedule the Work

A homeowner should coordinate with their chosen electrician to schedule the installation. It is wise to confirm the estimated duration of the work. This helps minimize disruption to the household. The electrician will install the dedicated circuit, run the necessary wiring, and mount the charging unit from a provider like TPSON.

Final Inspection and Permitting

After the installation, a final inspection by a local building or electrical inspector may be necessary. The electrician usually arranges this. A successful inspection results in a signed-off permit. This official approval confirms the work meets all safety codes and is often a requirement for the final approval of grants.

Step 5: Gather All Documentation

Meticulous record-keeping is the key to a successful application. A homeowner must collect and organize every piece of paperwork related to the project. This documentation serves as the evidence needed to claim incentives.

Itemized Invoices for Equipment

The homeowner needs the final, paid invoice for the charging unit. This document must be itemized, clearly showing the manufacturer, model number, serial number, and purchase price. A simple credit card statement is usually not sufficient.

Detailed Receipts for Labor

The electrician’s final invoice is equally important. It should provide a detailed breakdown of all costs:

- Labor charges

- Cost of materials like wiring and conduits

- Permitting fees

A single lump-sum cost is often rejected by program administrators.

Photos of the Final Installation

Many programs require visual proof of the completed project. A homeowner should take clear photographs of the final installation of their ev charger. Good photos include a wide shot showing the charger and the vehicle’s parking space, and a close-up of the charger’s serial number sticker.

Step 6: Submit Your Applications

With the installation complete and all documents in hand, the homeowner can finally apply for their savings. This step requires careful attention to detail to ensure all requirements are met.

Reminder: A homeowner should submit applications promptly. Many programs have funding limits and operate on a first-come, first-served basis.

Filing for Utility and State Rebates

The homeowner should use their compiled documents to complete the application for each state and utility program. They must double-check every form for accuracy before submission. Most programs now offer online portals for uploading documents, which simplifies the process to successfully apply for rebates and grants.

Claiming the Federal Credit at Tax Time

National-level tax credits are handled separately. The homeowner will use the same set of invoices and receipts when filing their annual taxes for their ev charger. They will need to complete the specific tax forms required by their country’s revenue agency to claim any available national-level grants or credits.

Installing home charging points is more affordable than many homeowners realize. The key to maximizing savings is strategically combining federal and state grants with other local grants. A clear action plan helps a homeowner navigate the process smoothly. This significantly reduces out-of-pocket costs for their new ev. Homeowners should start researching local incentives today. This makes the transition to ev driving easier and cheaper.

FAQ

Um proprietário pode instalar ele próprio um carregador de veículos eléctricos?

No, a homeowner should not perform a self-installation. Most grant programs and charger warranties require installation by a licensed and certified electrician. This ensures the work meets all local electrical codes and safety standards, protecting the home and the vehicle.

How does a homeowner choose the right charger for their EV?

A homeowner should first check the grant program’s qualified product list. They can then select a charger that meets their vehicle’s charging speed capabilities. Technologically advanced providers like TPSON offer smart chargers with useful features like remote scheduling and energy monitoring.

Is a smart charger necessary to receive grants?

Many utility and government grants require the installation of a smart, network-connected charger. These units help manage energy demand on the electrical grid. A homeowner must always verify the specific equipment requirements for each incentive program before making a purchase.

How long does a typical home charger installation take?

A standard installation can take a few hours. However, the timeline can extend if the job is complex. Factors like the distance from the electrical panel or the need for a panel upgrade will increase the total installation time.

Can a homeowner combine multiple grants for one charger?

Yes, many programs allow “stacking” incentives. A homeowner might combine a utility rebate with a regional grant. It is essential to read the terms for each program, as some may prohibit combining them with other specific financial incentives.

What should a homeowner do if their grant application is denied?

A homeowner should first review the denial reason provided by the program administrator. Common issues include missing documentation or an ineligible product. They can then correct the error and reapply if the program’s rules and timeline allow for resubmission.

Does an older home require special considerations for installation?

Yes, older homes often need an electrical system evaluation. The home’s main electrical panel may lack the capacity for a Level 2 charger. An electrician might recommend a panel upgrade to safely support the additional electrical load from the charger.