The UK is making significant progress toward an all-electric future, with over 1.1 million pure EV models now on its roads. الشركات المصنعة لشاحن السيارة الكهربائية are rapidly expanding the public charging network to keep pace. However, the nation is not fully prepared for a complete transition. The Future of UK Charging Points depends on accelerating this growth and integrating smart technologies.

Critical challenges in equitable infrastructure, grid capacity, and policy consistency must be addressed to ensure every EV driver has access to a reliable شاحن السيارة الكهربائية.

Assessing the Current UK Charging Infrastructure

The UK’s charging infrastructure is a complex landscape of private convenience and public challenges. A driver’s experience depends heavily on their location, housing type, and the types of chargers available nearby. Understanding this landscape is key to assessing national readiness.

Public vs. Private Charging: Is the Network Accessible?

Accessibility remains the central question for the UK’s charging networks. While the number of EV charging points grows, their distribution and availability create an inconsistent experience for drivers. The expansion of charging networks must address these inconsistencies.

The Dominance of Home Charging

Home charging is the most convenient and cost-effective method for EV drivers. Currently, approximately 60% of UK households have access to off-street parking, allowing them to install a private charge point. This majority enjoys the ease of overnight charging, starting each day with a full battery. However, this leaves a significant minority of drivers entirely dependent on the public charging network.

Analyzing Public Charger Growth

The public charging network is undergoing a period of rapid expansion. The government and private companies are investing heavily to increase the number of available charge points. This growth is critical for supporting the rising number of EV models on the road and building driver confidence. The goal is to create a dense and reliable network that makes long-distance travel as seamless as refueling a petrol car.

Urban vs. Rural Disparities

A significant imbalance exists in charger availability between urban and rural areas. Major cities like London have a high density of chargers, yet even this can be insufficient for the large number of residents. Rural regions often have very few options, creating major accessibility hurdles. The Competition and Market Authority (CMA) highlighted this issue.

This disparity creates a two-tiered system for EV drivers.

| Postcode Type | Charger Availability | Implication/Challenge |

|---|---|---|

| المناطق الريفية | Limited to no public chargepoints | Significant access issues |

| حضري | More public chargepoints | High density of EV drivers can still lead to insufficient infrastructure |

On-Street Solutions for Terraced Homes

Around 40% of UK households lack driveways, particularly those in terraced housing. This group needs reliable on-street charging solutions. Local authorities are exploring several options:

- Lamppost Chargers: Integrating chargers into existing street lighting offers a low-impact solution.

- Pavement Bollards: Retractable or fixed bollards provide dedicated charging spots.

- Community Hubs: Centralized charging hubs in residential areas serve multiple households.

These solutions are essential for making EV ownership a viable option for millions of people.

The Speed Gap: Are Fast Chargers Becoming the Norm?

The speed of charging is just as important as the availability of chargers. While a large network is good, a network of slow chargers can still create bottlenecks and frustration. The focus is shifting toward faster charging technologies to better match driver expectations.

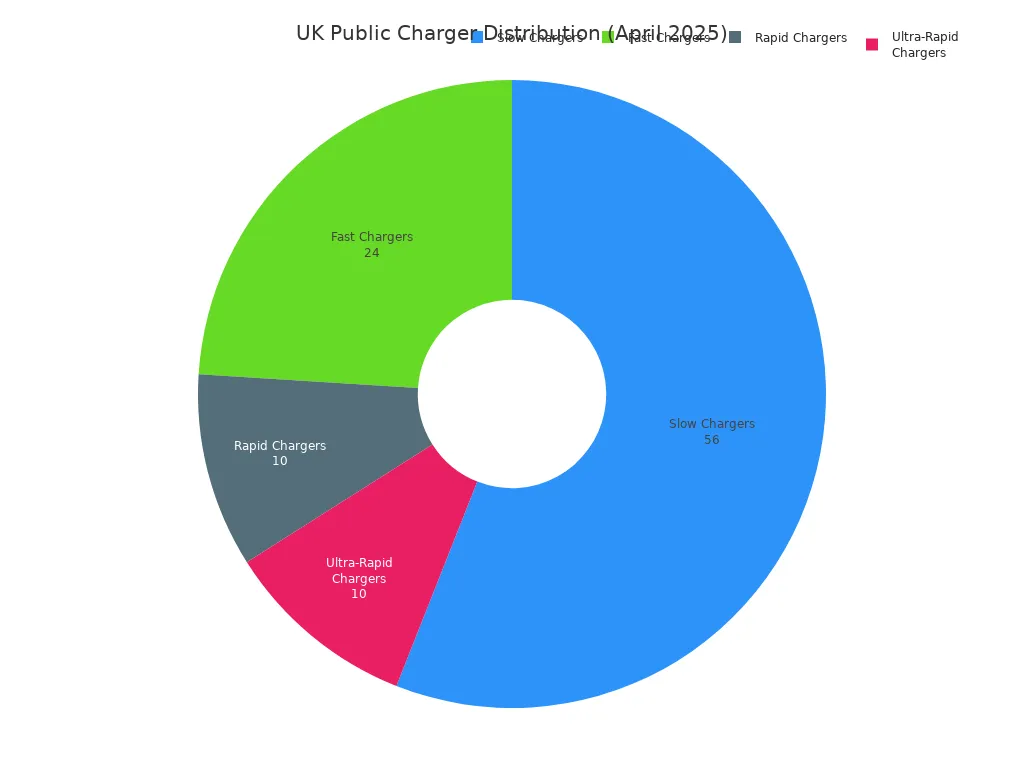

Slow, Fast, and Ultra-Rapid Ratios

The current public charging infrastructure is dominated by slower chargers. These are suitable for overnight or workplace charging but are less practical for quick top-ups during a journey. The adoption of ultra-fast charging technology is changing this balance, but slower units still form the majority of the network.

As of April 2025, the distribution highlights a reliance on slower charging speeds.

| نوع الشاحن | تصنيف الطاقة | Percentage of Network (April 2025) |

|---|---|---|

| Slow Chargers | 3kW to 8kW | 56% |

| Fast Chargers | 8kW to 49kW | 24% |

| Rapid Chargers | 50kW to 149kW | 10% |

| Ultra-Rapid Chargers | 150kW plus | 10% |

The Rise of Dedicated Charging Hubs

Dedicated charging hubs are becoming a common sight along major motorways and in urban centers. These hubs, operated by companies like Gridserve, Ionity, and BP Pulse, feature multiple high-speed chargers. They mimic the traditional petrol station experience, offering amenities like cafes and restrooms while drivers wait. These hubs are crucial for enabling long-distance EV travel.

Pacing Rollout with EV Sales

The installation of new EV charging points is currently keeping pace with the growth in EV sales. The rollout of ultra-fast chargers is particularly impressive. These 150kW+ units have seen a 51% increase in the last year alone, a growth rate that directly supports the new generation of electric vehicles capable of accepting higher charging speeds. This alignment is vital for preventing public charging capacity from being overwhelmed.

Future-Proofing with High-Power Chargers

Looking ahead, the charging infrastructure in 2025 and beyond must be future-proof. This means prioritizing the installation of ultra-fast chargers capable of delivering 150kW, 350kW, or even more. While not all current EVs can use these speeds, they ensure the infrastructure remains relevant as battery technology advances. Investing in these high-speed chargers today prevents the need for costly upgrades tomorrow and solidifies the foundation for an all-electric future.

Are Government Policies and Investments Accelerating the Transition?

Government action is a powerful driver of the UK’s electric transition. Policies create market certainty, while investments can fill critical infrastructure gaps. However, the effectiveness of these interventions depends on their design, funding, and execution. An analysis of current policies reveals a mix of strong signals and significant implementation challenges that influence electric vehicle trends.

Evaluating Policy Impact on Electric Vehicle Trends

Policy decisions directly shape consumer behavior and manufacturer strategies. The UK government has used several key levers to steer the market toward electrification. The impact of these policies on electric vehicle trends provides a clear picture of what is working and where gaps remain.

The 2035 Petrol and Diesel Car Ban

The government’s plan to ban the sale of new petrol and diesel cars from 2035 is the cornerstone of its decarbonization strategy. This policy sends a clear long-term signal to the industry and consumers. However, recent data suggests a disconnect between this goal and current purchasing habits.

- Demand for new electric vehicles has stalled, holding at 18% of new car enquiries despite a mandated 28% market share for 2025.

- Current sales trajectories project EVs will only make up 45% of new car sales by 2030, far short of the 80% target.

- Affordability remains a key barrier, with 52% of drivers citing price as their main concern.

- The popularity of hybrids is rising, now accounting for 37% of new car advert views.

This data highlights a consumer base that is hesitant about the upfront cost of new EVs, leading to a surge in the used market.

Ian Plummer, Commercial Director of Auto Trader, noted: “There is genuine concern that 80% of consumers doubt the Government can meet its 2030 goal of banning new petrol and diesel vehicle sales. While the availability of affordable new and used EVs is increasing, and the £1.4 billion recently committed by the Government to support the transition is promising, it may take time for these improvements to reach and reassure the wider public.”

Assessing Past Purchase Subsidies

The UK previously offered a Plug-in Car Grant to reduce the initial cost of buying an EV. The government phased out this subsidy for cars in 2022. This move shifted the market’s focus squarely onto the total cost of ownership. While subsidies helped early adoption, their absence now magnifies the price difference between electric and internal combustion engine (ICE) vehicles. The market has responded predictably.

- A vast majority of car buyers (78%) plan to spend under £20,000.

- Only 33 new EV models are available at this price point, compared to 108 ICE and hybrid options. This affordability gap pushes many potential buyers toward the used EV market, where enquiries have surged by 92% since June 2023.

The Role of Installation Grants

The government continues to offer grants for the installation of charging points at homes and workplaces. These grants have successfully encouraged the expansion of private charging infrastructure for those with access to off-street parking. They lower the financial barrier to getting a home charger, which is the most convenient and cheapest way to handle daily charging needs. However, their impact is limited for the 40% of UK households without driveways, who remain entirely dependent on public infrastructure.

Zero Emission Vehicle (ZEV) Mandate

The ZEV mandate is a powerful policy forcing manufacturers to increase their EV sales mix. It requires that 22% of a manufacturer’s new car sales in 2024 are zero-emission, a figure that rises to 80% by 2030. This regulation is creating a “push” market, where manufacturers must prioritize EV sales to meet quotas, potentially leading to attractive deals for consumers. The mandate has spurred several key strategies among automakers.

| Manufacturer Strategy | الوصف |

|---|---|

| Trading ZEV Credits | Companies exceeding their targets can sell surplus credits to those falling short. |

| Banking ZEV Credits | Building a reserve of credits provides a buffer against future market changes. |

| Borrowing Allowances | A short-term solution allowing companies to borrow from future CO₂ allowances. |

This policy is directly influencing production and sales, with battery electric vehicles (BEVs) growing 21% in 2024. However, the system is complex. One premium brand, for example, exceeded its ZEV target but still faced over £17 million in potential penalties for missing separate CO₂ targets.

Investment vs. Need: Is Capital Flowing Correctly?

Building a national charging network requires immense capital investment. The government’s role is to direct public funds toward strategic gaps that the private market will not fill on its own. Assessing whether this capital is flowing correctly involves comparing government initiatives and private investment against the projected needs of an all-electric nation.

The Rapid Charging Fund’s Role

The Rapid Charging Fund (RCF) was announced in 2020 with an ambitious goal. It was allocated £950 million to help fund ultra-rapid charging infrastructure at motorway service areas. The fund specifically targeted grid connection upgrades, which are often prohibitively expensive for private operators. Unfortunately, the RCF was scrapped in 2025 after five years without issuing a single grant. The unspent capital is now expected to be folded into a broader £400 million fund, but the delay represents a significant setback for motorway charging expansion.

Private Sector Investment Surge

The private sector is the primary engine driving the rollout of ev charging points. Companies like Gridserve, Ionity, BP Pulse, and Osprey are investing billions to build out their networks. This investment is market-driven, focusing on locations with high traffic and proven demand. While this approach delivers rapid growth in profitable areas, it risks widening the gap between well-served urban centers and underserved rural regions.

Comparing Investment to Projected Needs

The scale of the challenge is enormous. The EV Energy Taskforce projects that the UK will need £7 billion of investment in its public charging network by 2035. This funding is necessary to increase the number of charge points tenfold and meet future demand. The vast majority of this capital is expected to come from private investors. The government’s role is therefore not to fund the entire network but to de-risk investment in less profitable areas and ensure equitable access for all drivers.

Upgrading Local Grid Connections

A major hidden cost in the EV transition is upgrading local electricity grids. Many ideal locations for charging hubs lack the necessary grid capacity to support multiple rapid chargers. The process of applying for and funding a substation upgrade can be slow and expensive, acting as a major barrier to the installation of charging stations. This issue requires coordinated planning between charge point operators, local authorities, and Distribution Network Operators (DNOs) to streamline investment and construction.

Overcoming Regulatory and Planning Hurdles

Beyond funding, a web of regulations and planning rules governs the deployment of charging infrastructure. These rules are intended to ensure safety, accessibility, and a positive user experience. However, they can also create delays and add costs if not designed and implemented efficiently. Recent government action has aimed to tackle some of these long-standing hurdles.

Streamlining Installation Permits

Historically, securing planning permission for new chargers has been a slow and inconsistent process, varying significantly between local authorities. This uncertainty creates risk and delays projects. The government is working to streamline these processes, treating the installation of public chargers as a national priority. Faster permit approvals are essential for accelerating the network rollout at the pace required.

Mandating Chargers in New Builds

To future-proof the nation’s housing stock, the government introduced a landmark law in 2022. This legislation mandates that all new-build homes in England with associated parking must include an electric vehicle charge point. The law also applies to buildings undergoing major renovation. This forward-thinking policy ensures that future homeowners are EV-ready from day one, supporting long-term adoption and reducing pressure on the public network.

Mandating Contactless Payments

A major frustration for early EV drivers was the need for multiple apps and subscription cards to access different charging networks. New regulations now mandate that all new public chargers above 8kW and all existing rapid chargers must offer a contactless payment option. This simple change dramatically improves the user experience, making public charging as easy as paying for fuel. This move toward standardisation is a critical step for mainstream adoption.

Standardizing Signage and Access

Finding an available and working charger remains a challenge. To address this, new regulations require operators to provide open data on the location, status, and price of their chargers in real-time. This allows drivers to use a single app to find a working unit from any provider. The rules also mandate a 99% reliability standard for rapid networks and a 24/7 helpline. Together with the standardisation of charging connectors, these measures create a more reliable and user-friendly ecosystem.

Grid Readiness: Can the UK Power an EV Nation?

The transition to electric vehicles raises a critical question: can the UK’s national grid handle the load? Powering millions of EVs requires more than just generating extra electricity; it demands a smarter, more flexible grid. The solution lies in managing national capacity, overcoming local constraints, and embracing intelligent charging technologies.

National Grid Capacity and Local Constraints

The National Grid confirms that the UK has enough power for a fully electric fleet. The real challenge is not the total energy required but managing the timing of that demand. Local infrastructure bottlenecks also present a significant hurdle to a smooth transition.

Managing Peak Demand Scenarios

Uncontrolled charging, where every driver plugs in their EV upon returning home, could create unsustainable spikes in electricity demand. The National Grid projects a manageable increase in peak load if smart technologies are widely adopted.

| السنة | Peak Demand Increase (GW) | Percentage Increase (%) |

|---|---|---|

| 2030 | 3-8 | 4-14 |

| 2050 | 3-13 | 6-22 |

These projections depend heavily on shifting charging away from peak times. Without smart management, these figures could be significantly higher, straining the network.

The Need for Substation Upgrades

Grid capacity is not uniform across the country. Many areas face significant local constraints that prevent the installation of new rapid chargers.

- المناطق الريفية: These “charging deserts” often have older, single-phase grid connections, making it difficult and expensive to install the necessary infrastructure.

- المناطق الحضرية: Even in cities with more robust grids, clusters of chargers can overload local substations, creating a bottleneck for further expansion.

Integrating Renewable Energy Sources

Electric vehicles offer a unique opportunity to support the integration of renewable energy. The grid can encourage EV charging during periods of high wind or solar generation when electricity is abundant and cheap. This synergy helps balance the grid and advances national sustainability goals.

The Impact of Commercial EV Fleets

The electrification of commercial fleets presents both a challenge and an opportunity. A depot of vans charging simultaneously can place immense strain on a local grid connection. However, their predictable schedules make them ideal candidates for managed charging programs that can support grid stability.

Smart Charging: The Key to a Stable Grid

Smart charging is the most critical tool for managing the impact of EVs on the grid. It allows charging sessions to be shifted to off-peak hours automatically, reducing costs for drivers and preventing grid overload without requiring user intervention.

How Smart Tariffs Influence Behavior

Energy suppliers are increasingly offering dynamic tariffs that incentivize off-peak charging. Pilot programs from companies like Galp and ANWB have proven that drivers will change their behavior to take advantage of lower electricity prices overnight. This simple economic signal is highly effective at smoothing out demand.

The Potential of Automated Charging

Smart charging technology automates this process. Drivers simply plug in their car, and the system, guided by a mobile app, automatically schedules the charging session for the cheapest and greenest times. A program in California by MCE demonstrated this power, achieving an incredible 90% peak load reduction through managed charging.

Preventing Local Grid Overload

Smart charging directly addresses the risk of local grid overload. A UK case study at a large manufacturing site showed that uncontrolled charging by employees would create a new, damaging peak. By implementing a smart system, the EV charging load was spread across the day, completely eliminating the risk of exceeding the site’s power capacity.

البرامج التجريبية لتوصيل المركبات إلى الشبكة (V2G)

Vehicle-to-Grid (V2G) technology represents the next frontier. It allows EVs not only to draw power from the grid but also to export it back during times of high need.

The UK’s Sciurus Project, a major V2G trial, found that participants could earn an average of £80 per month by allowing their cars to support the grid. This demonstrates a clear financial benefit and a path toward a more resilient energy system.

The User Experience: Is Charging Convenient and Reliable?

A seamless user experience is the final piece of the puzzle for EV adoption. Even with enough chargers, the system fails if they are unreliable or difficult to use. The convenience of the charging experience hinges on both dependable hardware and user-friendly software.

The Challenge of Charging Infrastructure Reliability

Arriving at a public charger only to find it out of service is a major source of frustration for drivers. This issue of reliability remains a significant hurdle for the public charging infrastructure.

Understanding Charger Downtime

Charger downtime directly impacts driver confidence. While the network is improving, perfection remains elusive.

- A survey by Monta found 74% of UK charge point operators achieve uptime above 95%.

- However, only a mere 4% of operators reported an average uptime of 99.5% or higher.

This data shows that while most chargers work most of the time, a small but significant chance of failure persists across the networks.

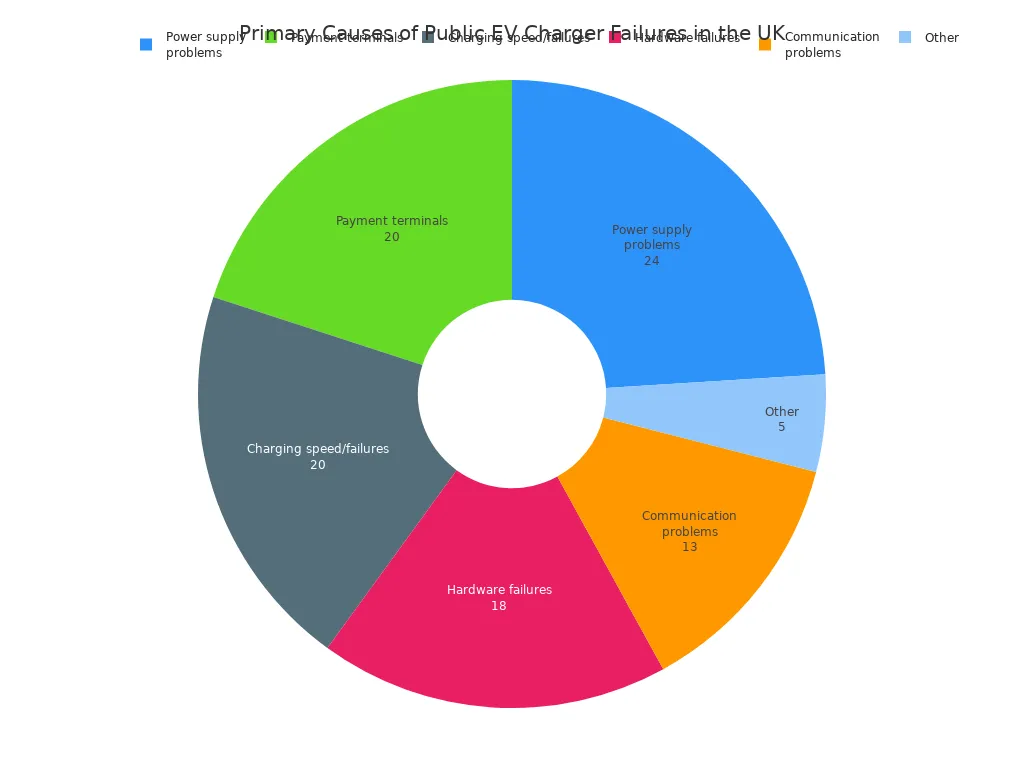

The Importance of Maintenance

Charger failures stem from a variety of causes, ranging from grid issues to physical damage. Proactive maintenance is essential to minimize these problems. Software glitches can cause blank screens or failed payments, while simple user error, like not connecting a cable securely, also contributes to perceived failures. Vandalism and cable theft are also growing concerns.

A breakdown of engineer callouts reveals the most common faults.

| Reason for Callout | النسبة المئوية |

|---|---|

| Power supply problems | 24% |

| Payment terminals | 20% |

| Charging speed/failures | 20% |

| أعطال الأجهزة | 18% |

| Communication problems | 13% |

| أخرى | 5% |

Reporting and Repairing Faults

A streamlined process for reporting and repairing faults is critical. New regulations require operators to provide a 24/7 helpline, ensuring drivers can report issues at any time. The speed at which operators dispatch technicians to fix broken units directly influences network dependability.

Network Uptime Guarantees

To combat unreliability, the government is setting clear standards. New regulations will require charge point operators to meet a 99% reliability rate. This ambitious target aligns the UK with other leading EV markets like the Netherlands و exceeds the 97% uptime mandated by the National Electric Vehicle Infrastructure (NEVI) program in the United States.

Software, Apps, and Payment Systems

Beyond hardware, the digital experience of finding, using, and paying for charging is equally important. A fragmented system of apps and payment methods has historically created confusion for drivers.

The Problem of Multiple Apps

In the past, drivers needed a wallet full of RFID cards and a phone full of apps to access different charging networks. An EV driver might need apps like Zapmap, Electroverse, and Bonnet for general use, plus others like Pod Point or ChargePlace Scotland for specific locations, creating unnecessary complexity.

Roaming and Interoperability

The industry is moving toward greater interoperability. Roaming agreements allow customers of one network to use another’s chargers seamlessly. The government’s EV Infrastructure Strategy also plans new legislation to mandate payment roaming, which will improve interoperability across different EV models and charging providers.

The Push for Simpler Payments

The simplest solution is often the best. Regulations now require all new public chargers over 8kW to offer contactless payment. This move makes public charging as straightforward as paying at a supermarket, removing a major barrier for new users. While most rapid chargers now have this feature, around 90% of slower chargers still rely on apps or RFID cards.

Real-Time Availability Data

Finding an available charger is as important as finding one that works. New rules compel operators to provide open, real-time data on charger location, status, and price. This allows third-party apps to show drivers exactly where to find an open and operational charging point, preventing wasted journeys.

The Future of UK Charging Points: Trends and Innovations

إن future of UK charging points is being shaped by rapid technological innovation. Beyond simply adding more chargers, the industry is developing smarter, more convenient, and grid-friendly solutions. This evolution is critical for building a network that can support a fully electric nation and defines the future of EV charging.

Exploring the Future of EV Charging Technology

New charging technology aims to solve key challenges related to convenience, space, and grid integration. The future of UK charging points will likely involve a mix of these advanced systems.

Vehicle-to-Grid (V2G) at Scale

Vehicle-to-Grid (V2G) technology transforms cars into mobile energy storage units that can sell power back to the grid. While this offers huge potential for grid stability, significant hurdles remain.

- High Costs: V2G hardware currently costs between £3,700 and £6,000, with complex installation adding another £1,000-£3,000.

- مشكلات التوافق: The technology is largely limited to vehicles with CHAdeMO connectors, awaiting wider adoption of the ISO 15118 standard for CCS-compatible cars.

- Regulatory Delays: Grid connection approvals can take months, slowing down residential installations.

The Viability of Wireless Charging

The future of EV charging includes cutting the cord entirely. Wireless, or inductive, charging allows a vehicle to recharge simply by parking over a ground-based pad. Real-world trials are already underway in the UK to test this technology. In Edinburgh, modified Vauxhall vans are testing wireless pads for commercial fleets, في حين أن a Nottingham project allows electric taxis to top up their batteries wirelessly while waiting for fares.

Battery Swapping for Niche Markets

Battery swapping offers a near-instant “refuel” by replacing a depleted battery with a fully charged one in minutes. While unlikely to become a mainstream solution for personal cars due to standardization challenges, it holds promise for commercial fleets like taxis or delivery vans, where minimizing vehicle downtime is a top priority.

Pop-Up and Mobile Charging Solutions

For the 40% of UK households without driveways, on-street charging solutions are essential. Pop-up chargers, a key innovation, address this need. Companies like Trojan Energy are installing retractable units in London that sit flush with the pavement when not in use. وبالمثل, BT Group is repurposing its old street cabinets into functional charging stations, cleverly using existing infrastructure.

Data and AI in Network Planning

Artificial intelligence is becoming a cornerstone for the future of UK charging points. By analyzing vast datasets, AI can optimize every aspect of the network, from location planning to grid management.

Predictive Analytics for Location Choice

AI algorithms analyze traffic patterns, local demographics, and existing grid capacity to predict the best locations for new charging stations. This data-driven approach ensures that investment is directed to areas with the highest potential demand, maximizing utility and return.

AI for Load Management

AI is crucial for preventing local grid overloads. Energy management systems, like those used by European operators such as Fastned, use AI to balance power across multiple chargers at a single site. The system can automatically adjust charging speeds in real-time, shifting demand away from peak hours to protect the grid.

Optimizing Charger Distribution

AI helps create a more equitable network. By identifying “charging deserts” in both urban and rural areas, it guides planners to fill critical gaps. This ensures the future of UK charging points provides fair access for all drivers, regardless of their location.

Enhancing the Driver Experience

Ultimately, AI improves the charging experience for every EV driver. It powers apps that provide real-time data on charger availability, predict wait times, and suggest alternative charging locations. This intelligence removes uncertainty and makes public charging more reliable and stress-free.

The UK is on a promising trajectory but is not yet fully prepared for a 100% electric vehicle fleet. While the nation is on track to meet its 300,000 public charger target by 2030, significant hurdles persist.

Achieving full readiness requires a united effort. This involves effective planning, smart charging integration, and building a reliable charging infrastructure to ensure a positive driver experience.

Key challenges in equitable access and local grid modernization must be overcome. The outlook is one of cautious optimism; the goal is within reach, but the most critical implementation phase is now.

الأسئلة الشائعة

How many public chargers does the UK need?

The government targets 300,000 أجهزة الشحن العامة by 2030. The EV Energy Taskforce projects a tenfold increase from current levels is necessary. This expansion requires around £7 billion in investment, mostly from the private sector, to meet future demand from a fully electric fleet.

What if I don’t have a driveway for home charging?

Local authorities are deploying on-street solutions for the 40% of households without private parking.

- Lamppost Chargers: Utilize existing street furniture.

- Pop-up Bollards: Retract into the pavement when not in use.

- Community Hubs: Serve multiple residents in a central location.

Are public chargers reliable?

Reliability is improving significantly. New regulations require rapid charger networks to achieve a 99% uptime rate. Operators must also provide a 24/7 helpline for reporting faults, ensuring issues are addressed quickly and driver confidence grows.

Do I need multiple apps to charge my EV?

This is becoming less common. New rules mandate contactless payment options on all new rapid chargers, making payment simple. 💳 Greater network interoperability and roaming agreements also mean drivers can use different networks without needing separate apps or cards.

Can the national grid handle millions of EVs?

Yes, the National Grid confirms it has enough total energy capacity. The main challenge is managing demand. Smart charging technology is the key solution. It shifts charging to off-peak hours, preventing grid strain and lowering costs for drivers.

What is the ZEV mandate?

The Zero Emission Vehicle (ZEV) mandate is a government policy requiring car manufacturers to sell a rising percentage of zero-emission vehicles each year.

| السنة | Required ZEV Sales |

|---|---|

| 2024 | 22% |

| 2030 | 80% |

| 2035 | 100% |

This policy directly pushes the market toward electrification by setting clear targets for the industry.